Medicare Planning: 6 Things All Medicare-Eligibles Should Do Today

November 25, 2013

By Amy De Vore+

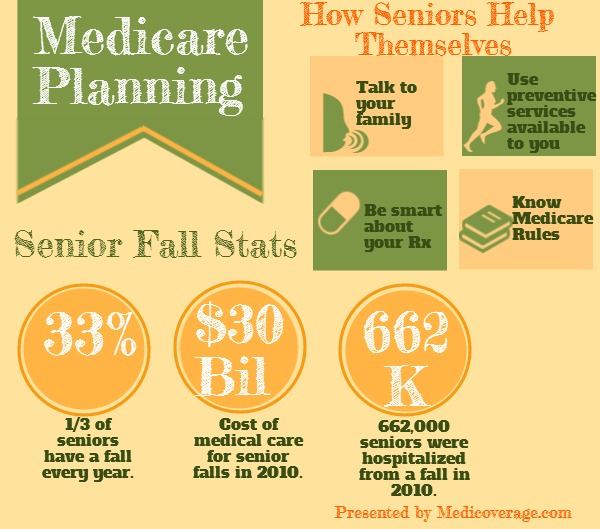

Many Seniors 65 and over are very independent and are living their lives with little to no assistance. As November is National Medicare Family Caregiver’s Month, we decided to write an article about what you and family can do now to ensure you maintain your best healthcare as you get older.

1) Talk to Family Today

Seniors need to sit down and talk with their family about their future healthcare needs in advance. Right now, you may not foresee any complications with your health in the near future but when accidents happen, you may not be in a position to communicate your wishes. Craig Fukishama, a consultant at the Fox Group, says, “Don’t wait to plan.” He goes on to say, “It is too late when something serious happens.”

The following is a quick list of questions that you should discuss with your family member is advance. Some of the questions should be part of a formal Living Will that you can develop with legal assistance.

- Who is the emergency contact?

- Which doctors are your currently working with?

- What drugs are you currently taking?

- Do you qualify for Medicaid?

- What additional insurance you have purchased? (See number 2 below)

- Do you want to be resuscitated, etc?

2) Consider Senior Insurance

Medicare will not cover all your medical costs should you be sick or injured. As the New York Times states, “The average married couple retiring this year at age 65 need $220,000 to cover health costs throughout retirement.” You should consider getting additional coverage to keep the high cost of medical bills in check. Here is a list of insurance you may want:

3) Understand Medicare’s Rules

Many seniors don’t understand what is exactly covered under Medicare and don’t know the protocol to follow to to get reimbursed for expenses. Adria Gross, of Med Wise Billing, says that seniors and their families don’t understand that you need a 72 hour qualifying hospital stay to have Medicare cover their share of Skilled Nursing care.

“Someone was out in California at the hospital for three weeks and they were not covered by Part A [Medicare] for the Medicare bill,” Gross states because this patient was being held under “observation,” not considered admitted. Gross goes on to say, “You’ve got to really ask, because they think because they are at the hospital they are considered an in-patient, but many times they will still be considered as an out-patient.”

Gross stresses that patients should ask after a few hours at the hospital what there in or out-patient status is. Asking the right questions can save thousands of dollars, but if you are not familiar with how medicare works you will not be able to ask the right questions.

4) Be Smart About Drugs

Seniors should be vigilant about how they take their drugs and how they will be paid for. Jen Wolfe, a pharmacist in the DC area started her own consulting firm ( Mymedicationexpert.com) after a client of hers had a heart attack in her pharmacy because he was not taking his drugs as prescribed. She suggests the following steps for seniors to be smart about drugs:

- Talk to their doctors and pharmacists about all the drugs they are taking to make sure there isn’t an adverse reaction from a combination of drugs

- Have Medicare Part B, because it covers cancer drugs, injectibles, nebulizers, and anti-nausea drugs

- Get a Medicare Part D prescription drug plan, even if they are not taking a lot of medications currently

- Take all drugs as they are prescribed

- Put extra money aside each month for possible drug cost increases

- Go to the Medicare website and look up all the their current drugs to help decide which drug plan to enroll in

5) Use Medicare Preventive Services

Senior healthcare is not just about worrying about the financial end of things, it’s also about making sure that you use all of Medicare’s or your Medicare Insurance’s preventive services. With many of the Medicare Supplemental plans (Medigap plans) and MA plans including gym memberships, seniors should utilize this benefit to improve balance and prevent disease. Also the ACA has included $0 charge for Medicare preventive care beneficiaries that include tobacco cessation counseling, vaccinations, and mammograms.

6) Avoid Falls (not the Niagara type)

Fukishama says that one of the main reasons seniors are at Long Term Care facilities is due to a fall, and many times it is because their vision had diminished. Get an annual vision checkup to make sure you peepers are in order.

As well as, according to Centers for Disease Control and Prevention, 1 in 3 seniors has a fall every year. Falls are leading cause of both non-fatal and fatal injuries among seniors. “In 2010, 2.3 million nonfatal fall injuries among older adults were treated in emergency departments and more than 662,000 of these patients were hospitalized,” according to the CDC. And the CDC explains how costly falls are for American seniors, “In 2010, the direct medical costs of falls [adjusted for inflation] was $30 billion.”

Conclusion:

Family members often become the default caregivers when seniors become ill or injured. If you plan ahead and make smart decisions you can give them the tools to really assist you and maybe even postpone needing their help with some preventive planning.

How Medicaid Works With Medicare Advantage

August 07, 2013

By Katie Banks+

If you are over 65 and eligible for Medicaid, you might be able to enroll in Medicare Advantage, AKA Medicare Part C. This is good news for seniors who have added benefits that Original Medicare doesn’t offer.

Medicare Advantage Benefits

These plans can offer extras that Original Medicare doesn’t such as dental, vision, prescription drug coverage, and gym memberships. This is all added on to the guarantee that Medicare Advantage plans must offer what Medicare offers to seniors. To learn more read the article, What is Medicare Advantage? If you qualify for Medicaid you may be able to have your Medicare Advantage premium paid for among other benefits.

Medicaid Overview

A federal-State funded health insurance program for those who qualify by need. Who qualifies?

- Depends on which state how they handle Medicaid

- ObamaCare expanded Medicaid eligibility to individual incomes up to $15, 281

- If your state has blocked the Medicaid expansion each state has its own rules

Medicaid and Seniors

This is what is most important to you or your loved one. If you are considered a Qualified Medicare Beneficiary (QMB), generally, falling below 100% FPL (again depends on the state), Medicaid may cover or completely your Medicare Part A premium, Part B premium, copays, coinsurance, and deductibles, plus, and this is a big plus, in some states Medicare Part C’s premium, commonly known as Medicare Advantage.

Spend Down can Help You Get Medicare Advantage

“Spend Down” is a Medicaid loophole for the medically needy, but who don’t financially qualify. What this program allows you do to is subtract your medical expenses from your income to become eligible for Medicaid. Again, this all depends on your state. To learn if your state allows for spend down call 800-930-7956.

For any further questions about Medicare Advantage and Medicaid call the number above or contact Medicoverage for assistance.

Blue Shield of CA Medicare Supplement Open Enrollment Extended

August 03, 2013

By Ray Wilson+

Blue Shield of California announced that it extended its Special Open Enrollment Period (SEP) for Medicare Supplement (Medigap) through June 30, 2014.

Any senior in California with an existing Medicare Supplement plan may transfer to any open Blue Shield Medigap plan with equal or lesser benefits. For current Blue Shield Medigap members you only have to complete a transfer application. For clients from a different provider you can submit a new application without having to submit a health questionnaire.

Medigap offers financial protection for seniors from major health issues because it fills in the gaps that Original Medicare leaves open. Click here to learn more about Medigap.

To apply today for a Blue Shield transfer go to our online application or call 800-930-7956.

Applying for Medicare

April 04, 2011

By Katie Banks+

When should I apply?

If you are currently receiving Social Security retirement benefits, disability benefits, or railroad retirement checks, you will be contacted a few months before you become eligible for Medicare and given the information you need. If you live in one of the 50 states or Washington, D.C., you will be enrolled in Medicare Parts A and B automatically. However, since you must pay a premium for Part B coverage, you are given the option of turning it down.

NOTE: Residents of Puerto Rico or foreign countries will not receive Part B automatically. They must elect this benefit.

If you are not already getting retirement benefits, you should contact the Social Security Administration about three months before your 65th birthday to sign up for Medicare. You can sign up for Medicare even if you do not plan to retire at age 65.

Special enrollment situations

You also should contact Social Security about applying for Medicare if the following circumstances apply to you:

- You are a disabled widow or widower between the ages of 50 and 65, but you have not applied for disability benefits, because you are already getting another kind of Social Security benefit;

- You are a government employee and became disabled before age 65;

- You, your spouse, or your dependent child has permanent kidney failure;

- You had Medicare medical insurance in the past but dropped the coverage; or

- You turned down Medicare medical insurance when you became entitled to hospital insurance (Part A).

Initial enrollment period for Part B

When you first become eligible for hospital insurance (Part A), you have a seven-month period (your initial enrollment period) to sign up for medical insurance (Part B). A delay on your part will cause a delay in coverage and result in higher premiums. If you are eligible at age 65, your initial enrollment period begins three months before your 65th birthday. It will include the month that you turn 65, and it will end three months after that birthday. If you are eligible for Medicare based on disability or permanent kidney failure, your initial enrollment period depends on the date your disability or treatment began.

When does my enrollment in Part B become effective?

If you accept the automatic enrollment in Medicare Part B, or if you enroll in Medicare Part B during the first three months of your initial enrollment period, your medical insurance protection will start with the month you are first eligible. If you enroll during the last four months, your protection will start from one to three months after you enroll. To apply for Medicare go to the Medicare Enrollment Overview page.

General enrollment period for Part B

If you do not enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a “general enrollment period” from January 1 through March 31. Your coverage begins the following July. However, your monthly premium increases 10 percent for each 12-month period you were eligible for, but did not enroll in, Medicare Part B.

Special enrollment period for people covered under an employer group health plan

If you are 65 or older and are covered under a group health plan, either from your own or your spouse’s current employment, you have a “special enrollment period” in which to sign up for Medicare Part B. This means that you may delay enrolling in Medicare Part B without having to wait for a general enrollment period and paying the 10 percent premium surcharge for late enrollment. The rules allow you to:

- Enroll in Medicare Part B any time while you are covered under the group health plan based on current employment; or

- Enroll in Medicare Part B during the eight-month period that begins following the last month your group health coverage ends, or following the month employment ends—whichever comes first.

Special enrollment period rules do not apply if employment or employer-provided group health plan coverage ends during your initial enrollment period.

If you do not enroll by the end of the eight-month period, you will have to wait until the next general enrollment period, which begins January 1 of the next year. You also may have to pay a higher premium, as explained above.

People who receive Social Security disability benefits and are covered under a group health plan from either their own or a family member’s current employment also have a special enrollment period and premium rights that are similar to those for workers age 65 or older.

Medicare Part D (Medicare Prescription Drug Coverage)

April 04, 2011

By Katie Banks+

Medicare prescription drug coverage is insurance run by an insurance company or other private company approved by Medicare. There are two ways to get Medicare prescription drug coverage:

1. Medicare Prescription Drug Plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, and Medical Savings Account (MSA) Plans.

2. Medicare Advantage Plans are other Medicare health plans that offer Medicare prescription drug coverage. They include full Part A and Part B coverage, as well as prescription drug coverage (Part D).

If you decide not to join a Medicare drug plan when you’re first eligible, and you don’t have other credible prescription drug coverage, you will likely pay a late enrollment penalty.

How Much Does Medicare Prescription Drug Coverage Cost?

Each plan can vary in cost and drugs covered. Our Quoting Tool can help you find and compare plans in your area.

Your Part D monthly premium could be higher based on your income. This includes Part D coverage that you receive from a Medicare Prescription Drug Plan, a Medicare Advantage Plan or Medicare Cost Plan that includes Medicare prescription drug coverage. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount, you will pay a higher monthly premium.

Many people qualify to get assistance in paying for their Medicare prescription drug costs, but don’t know it. Most who qualify and join a Medicare drug plan will get 95% of their costs covered. For those who need additional help, there are Medicare Savings Programs available to aid in making health care and prescription drug costs more affordable.

How Do I Get Medicare Prescription Drug Coverage?

To join a Medicare Prescription Drug Plan, you must have Medicare Part A or Part B. To join a Medicare Advantage Plan, you must have Part A and Part B. You must also live in the service area of the Medicare drug plan you want to join.

Remember, costs and coverage varies with each plan. Using our Quoting Tool can help you find and compare plans in your area. See the Senior65 Medicare Part D page for a complete overview on Medicare prescription plans.

How Does My Other Insurance Work with Medicare Drug Coverage?

If you have other insurance, find it below to understand how it works with, or is affected by, Medicare prescription drug coverage.

Employer or Union Health Coverage

This is health coverage based on the current or former employment of you, your spouse, or other members of your family. If you have prescription drug coverage based on employment, the employer or union will notify you each year to let you know if your drug coverage is creditable. It is important to keep the information that you receive.

If you join a Medicare drug plan, you, your spouse, or your dependants may lose your employer or union health coverage. Call your benefits administrator for more information before making any changes to your coverage.

COBRA

This is a Federal law that may allow you to temporarily keep employer or union health coverage after employment ends, or after you lose coverage as a dependent of a covered employee.

There may be reasons why you should take Part B instead of COBRA. However, if you take COBRA and it includes creditable prescription drug coverage, you will have a special enrollment period to join a Medicare drug plan without paying a penalty when the COBRA coverage ends.

Medigap (Medicare Supplement Insurance) Policy with Prescription Drug Coverage

Medigap policies are no longer sold with prescription drug coverage. If you currently have drug coverage under a Medigap policy, you may keep it. However, you may opt to join a Medicare drug plan instead, because most Medigap drug coverage isn’t creditable.

If you join a Medicare drug plan, your Medigap insurance company must remove the prescription drug coverage under your Medigap policy and adjust your premiums. Call your Medigap insurance company for more information.

The types of insurance listed below are all considered creditable prescription drug coverage. If you have one of these types of insurance, in most cases, it will be to your advantage to keep your current coverage.

Federal Employee Health Benefits Program (FEHBP)

If you join a Medicare drug plan, you can keep your FEHBP plan, and your plan will let you know who pays first. For more information, contact the Office of Personnel Management at 1-888-767-6738, or visit the Office of Personnel Management website. TTY users should call 1-800-878-5707. You can also call your plan if you have questions.

Veterans Benefits

You may be able to get prescription drug coverage through the U.S. Department of Veterans Affairs (VA) program. You may join a Medicare drug plan, but if you do, you can’t use both types of coverage for the same prescription. For more information, call the VA at 1-800-827-1000, or visit the VA website. TTY users should call 1-800-829-4833.

TRICARE (Military Health Benefits)

Most people with TRICARE who are entitled to Part A must have Part B to keep TRICARE prescription drug benefits. If you have TRICARE, you aren’t required to join a Medicare drug plan. If you do, your Medicare drug plan pays first, and TRICARE pays second. If you join a Medicare Advantage Plan with prescription drug coverage, TRICARE won’t pay for your prescription drugs. For more information, call the TRICARE pharmacy contractor at 1 877 363 8779, or visit the Tricare website. TTY users should call 1-877-540-6261.

Indian Health Services

If you get prescription drugs through an Indian health pharmacy, you pay nothing and your coverage won’t be interrupted. Joining a Medicare drug plan may help your Indian health provider with costs, because the drug plan pays part of the cost of your prescriptions. Talk to your benefits coordinator - they can help you choose a plan that meets your needs and explain how Medicare works with your health care system.

Medicare Advantage Plan (Part C)

April 04, 2011

By Katie Banks+

What is a Medicare Advantage Plan (Part C)?

A Medicare Advantage Plan is another health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A (Hospital Insurance) and Part B (Medical Insurance) coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage (Part D).

Medicare pays a fixed amount for your care every month to the companies that offer Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs, and they can have different rules for how you obtain services (such as whether you need a referral to see a specialist). These rules can change each year.

Different Types of Medicare Advantage Plans

- Health Maintenance Organization (HMO) Plans

- Preferred Provider Organization (PPO) Plans

- Private Fee-for-Service (PFFS) Plans

- Special Needs Plans (SNP)

There are other less common types of Medicare Advantage Plans that may be available:

- HMO Point of Service (HMOPOS) Plans— An HMO plan that may allow you to get some services out-of-network for a higher cost.

- Medical Savings Account (MSA) Plans—A plan that combines a high deductible health plan with a bank account. Medicare deposits money into the account (usually less than the deductible). You can use the money to pay for your health care services during the year.

How Much Does a Medicare Advantage Plan Cost?

In addition to your Part B premium, you usually pay one monthly premium for the services included. Each Medicare Advantage Plan can charge different out of-pocket costs. Your out-of-pocket costs in a Medicare Advantage Plan depend on:

- Whether the plan charges a monthly premium.

- Whether the plan pays any of your monthly Part B premium.

- Whether the plan has a yearly deductible or any additional deductibles.

- How much you pay for each visit or service (copayments or coinsurance).

- The type of health care services you need and how often you get them.

- Whether you follow the plan’s rules, like using network providers.

- Whether you need extra benefits and if the plan charges for them.

- The plan’s yearly limit on your out-of-pocket costs for all medical services.

What Does a Medicare Advantage Plan Cover?

In all types of Medicare Advantage Plans, you’re always covered for emergency and urgent care. Medicare Advantage Plans must cover all of the services that Original Medicare covers, with the exception of hospice care. Original Medicare covers hospice care, even if you’re in a Medicare Advantage Plan. Medicare Advantage Plans are not supplemental coverage; they may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage (Part D).

For your consideration: If looking for more comprehensive coverage, Medicare Supplemental, AKA Medigap, offers the greatest financial protection for seniors. To learn more about Medigap go to the Medigap Overview Page for Seniors.

How Do I Get a Medicare Advantage Plan?

Not all Medicare Advantage Plans work the same way, so before you join, take the time to find and compare Medicare health plans in your area. You can find quotes and compare plans easily using our Quoting Tool.

Medicare Part B

April 04, 2011

By Katie Banks+

What Is Part B (Medical Insurance)?

Part B helps cover medically-essential needs, such as doctors’ services, outpatient care, and home health services. Part B also covers some preventive services. Check your Medicare Card to find out if you have Part B.

How Much Does Part B Cost?

If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount. Social Security will contact some people who have to pay more depending on their income. If you don’t sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty. Ready to sign up for Medicare? Go to our Medicare Enrollment page.

Some people automatically get Part B. Learn how and when you can sign up for Part B via our

Applying for Medicare article.

What Does Part B Cover?

Part B covers two types of services:

- Medically-necessary services — Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventive Services—Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

Medicare Part A (Hospital Insurance)

April 04, 2011

By Katie Banks+

What Is Part A (Hospital Insurance)?

Part A is hospital insurance that helps cover inpatient care in hospitals and skilled nursing facilities, as well as hospice and home health care.

How Much Does Part A Cost?

Most people don’t pay a premium for Part A, because they paid Medicare taxes while working. This is called “premium-free Part A.”

If you are not eligible for premium-free Part A, you may be able to buy Part A if you meet one of the following conditions:

- You are 65 or older, entitled to (or enrolling in) Part B, and meet the citizenship or residency requirements.

- You are under 65, disabled, and your premium-free Part A coverage ended because you returned to work. (If you’re under 65 and disabled, you can continue to get premium-free Part A for up to 8.5 years after you return to work.)

In most cases, if you choose to buy Part A, you must also have Part B and pay monthly premiums for both. If you have limited income and resources, your state may assist you in paying for Part A and/or Part B

How Do I Get Part A?

Some people automatically get Part A. Learn how and when you can sign up for Part A via our Applying for Medicare article

What Does Part A Cover?

In general, Part A provides coverage for:

- Inpatient care in hospitals (such as critical access hospitals, inpatient rehabilitation facilities, and long-term care hospitals)

- Inpatient care in a skilled nursing facility (not custodial or long term care)

- Hospice care services

- Home health care services

- Inpatient care in a Religious Non-Medical Health Care Institution

Note: Staying overnight in a hospital doesn’t always mean you’re an inpatient. You are considered an inpatient the day a doctor formally admits you to a hospital with a doctor’s order. Being an inpatient or an outpatient affects your out-of-pocket costs. Always ask if you’re an inpatient or an outpatient.

Medicare Under Health Care Reform

March 28, 2011

By Katie Banks+

- Due to a reduction in waste, fraud, and abuse, as well as a slowing cost growth in Medicare, the life of the Medicare Trust fund will be extended to at least 2029 (a 12-year extension). This will provide you with future cost savings on your premiums and coinsurance.

- Medicare plans on taking strong action to reduce payment errors and keep waste, fraud, and abuse at low levels. In addition, the President has made a commitment to reduce Medicare fraud by 50 percent before the year 2012. With the Affordable Care Act, an historic $350 million investment has been made to enforce this commitment. The financial boost will help prevent, detect and fight fraud in Medicare, as well as Medicaid and the Children’s Health Insurance Program.

- In 2011, if you hit the prescription drug donut hole, you will get a 50% discount on brand-name medications. Every year after, the cost of prescription drugs in the donut hole will be reduced, until there’s complete coverage of the donut hole in 2020. Between now and then, you will get continuous Medicare coverage for your prescription drugs.

- The coordination of care between doctors and the overall quality of care will be improved. This way, you will be less likely to experience preventable and harmful re-admissions to the hospital for the same condition.

Hospitals will have new, strong incentives to improve your quality of care.

- Starting in 2014, the Affordable Care Act will offer additional protection for Medicare Advantage Plan members. Such measures include taking strong steps that limit spending on administrative costs, insurance company profits, and things other than health care.

Top 5 Ways the Affordable Care Act affects Medicare-Eligible citizens

March 09, 2011

By Katie Banks+

Many people ask how the Affordable Care Act, which is also know as Obama Care, will affect seniors. We have put together 5 ways health reform will impact (or not impact) seniors below;

1.Your existing guaranteed Medicare-covered benefits will not be reduced or taken away. Neither will your ability to choose your own doctor.

2.If you had Medicare prescription drug coverage and had to pay for your drugs in 2010, as a result of the coverage gap known as the “Donut Hole,” you received a one-time, tax free $250 rebate from Medicare to assist in paying for your prescriptions.

3.Beginning this year, if you have high prescription drug costs that put you in the donut hole, you receive a 50% discount on covered brand-name drugs while you’re in the donut hole. Between 2010 and 2020, you will continue to get Medicare coverage for your prescription drugs. The donut hole will be closed completely by 2020.

4.Medicare covers certain preventive services without charging you the Part B coinsurance or deductible. An annual wellness exam will also be offered to you free of charge.

5.The life of the Medicare Trust fund will be extended to at least 2029. This 12-year extension is a result of reduced waste, fraud, and abuse, as well as a slowing cost growth in Medicare, which will provide you with future cost savings on your premiums and coinsurance.

If you have any questions, click here to learn more about medicare changes from the new healthcare reform.

How to switch from your Medicare Advantage Plan to Original Medicare

January 26, 2011

By Jack Regan

Starting this year, Medicare Advantage plan enrollees will have an annual opportunity to prospectively disenroll from any MA plan and return to Original Medicare between January 1 and February 14 of every year. The effective date of a disenrollment request made using the Medicare Advantage Disenrollment Period (MADP) will be the first of the month following receipt of the disenrollment request.

Example: A request made in January will be effective February 1, and a request made in February will be effective March 1.

The Medicare Advantage Disenrollment Period does not allow a member to change to a different type of Medicare Advantage plan, only Original Medicare.

Medicare Advantage (MA) enrollees using the Medicare Advantage Disenrollment Period (MADP) to disenroll January 1 through February 14 are also eligible for a coordinating Part D Special Election Period (SEP) to enroll in a Part D plan and may request enrollment in a PDP during the same timeframe.

Members enrolled in MA-only PFFS plans must request disenrollment from the MA-only plan to be eligible for this SEP as enrollment in a PDP will not result in automatic disenrollment from the MA-only plan. For other plan types, the member can simply enroll in a PDP using their SEP-MADP and they will be removed from their current Medicare Advantage Part D plan and enrolled in Original Medicare and the Part D plan of their choice.

And remember, if you have a customer who is considering disenrolling from a Medicare Advantage plan, this may be a good time to introduce one of our Modernized Medicare Supplement plans. These new plans are competitively priced and will be attractive to an even wider range of Medicare-eligibles.

Thank you for your attention to all rules and regulations that govern the sale of Medicare Advantage and Prescription Drug health plans.

To learn more contact a Medicoverage Agent

Aetna Illinois offers new rates and applications for Medicare Supplemental Plans

May 13, 2010

Medicoverage Staff

Aetna has just received approval from the state of Illinois for their premium rate structures for Aetna Individual Medicare Supplement Plans. In March 2010, Aetna was in the process of obtaining state approval to market their MIPPA-compliant Individual Medicare Supplement plans for policy effective dates of June 1, 2010 and later. These requests were just approved by the state and do not affect dental insurance for seniors

Aetna Medicare Supplemental Plan Offerings

There is no change in the plans Aetna offers in Illinois.They will continue to offer Plans A, B and F. There is, however, a new application which now contains a comprehensive Producer Certification section (Section 9). This must be used for all policies effective June 1, 2010 or later. Additionally the Outline of Coverage was updated to comply with MIPPA and include rate information. When it come to guaranteed issuance there were really no new changes except when necessary to reflect state requirements although in the Notice to Applicant does clarify that pre-existing condition limitations may apply. As mentioned before Aetna medigap rate sheets are now included as part of the Outline of Coverage.

To learn more about senior supplemental, visit our medigap page. If you would like to apply for Aetna senior coverage in Illinois please contact Medicoverage.

2010 Medigap Modernization: 6 Facts You Must Know

May 04, 2010

By Amy De Vore+

Medigap Modernization has been a hot topic in the media lately, and for good reason. Medigap, which is another name for Medicare supplemental insurance, is changing on June 1st, 2010 and the coming changes have potential for significant impact on seniors who are currently in the market for Medigap insurance.

There are 6 key facts that you must know now in order to make the best decision regarding your current or future Medigap policy.

Fact 1: “Medigap Modernization” is the nickname for the changes that Medigap will undergo starting on June 1st, 2010.

Though the changes that will affect consumers go into affect this year, the modernization process started much earlier.

As a requirement of the Medicare Prescription Drug Improvement and Modernization Act of 2003 (MMA), the National Association of Insurance Commissioners (NAIC) assembled a task force to improve Medigap plans and benefits. This task force included state regulators, consumer advocates, industry representatives, CMS representatives and other interested parties. They developed a modernization proposal that was approved by the NAIC in 2007.

Then on July 15, 2008, Congress enacted a law called the Medicare Improvements for Patients and Providers Act of 2008 (MIPPA). MIPPA included direction to the Secretary of Health and Human Services to implement modernization proposal developed by the NAIC-led task force. That modernization proposal, referred to in the MIPPA law as the NAIC Medigap Model Regulations, includes all the changes to Medigap that will take place on June 1, 2010.

Fact 2: There will be fewer total plans available for sale.

There are currently 12 senior medical insurance plans for sale and these are named for the letters of the alphabet A through After June 1st there will be 10 plans. By clicking on the link below, you can see a PDF table of the plans available for sale through May 31st, 2010.

Medigap-Table.pdf

Starting on June 1st, plans E, H, I and J will no longer be offered for sale. The PDF table below summarizes the new plans and their benefits available starting in June.

Medigap-June-2010.pdf

Fact 3: Two new Medigap plans will be sold.

Though four plans will be eliminated (see Fact 2 above), two new ones will be available for sale. Plans A through N will be available as Medigap plans. The PDF table above shows a summary of all the plans and their benefits, including these two new offerings.

Fact 4: Some Medigap benefits will change.

Some changes will affect all policies, while others will affect only one or a few Medigap policies. The best way to understand how the plans will change is to print out the PDF tables (above) and compare them side by side. That way you can see how each plan has changed or stayed the same. For example, you’ll see that the May 2010 Medigap Plan D covers >“At Home Recovery expenses while the June 2010 Medigap Plan B does not. If you are interested in reading about some of the nitty-gritty details of the changes, see our article titled .

Fact 5: Existing Medigap policyholders may keep their old policies.

This means that if you currently have one of the plans that is slated to be discontinued and you like it, you can keep it. This also means that if you see a plan that is currently offered for sale that will be discontinued after June 1st, you should buy it now.

Fact 6: There is no single Medigap plan that is the best for everyone.

According to the Medicare Rights Center, the most popular Medigap plans are currently C and F, because they cover major benefits and tend to be less expensive than some of the other plans. A quick comparison of the pre and post-June 1st Medigap charts (above) will confirm that these two plans will stay fundamentally the same.

Ready to sign up today? Go to the Medigap Overview Page.

However, it is extremely important to examine all of the plans while keeping in mind which benefits are most important to you and which you can do without. As with most decisions, the decision about which Medigap plan is right for you is all about trade-offs. What can you give up in order to have more of what you value most?

Next steps to choosing the right Medigap plan.

To obtain quotes on any Medigap plan, visit our quote engine and enter your zip code in the box at the top of the page. (All other information is optional.) Then click on the button on the bottom of the page. Once you do, you will be given a list of quotes on Medigap policies available in your area. From there you can shop based on price, provider reputation, and customer reviews.

In short, Medigap Modernization simply refers to the changes that the Federally standardized Medigap policies will undergo starting on June 1st, 2010. Again, if you are a researcher at heart and are interested in reading more about these changes, see our page called “Medigap Changes Coming June 1st.”

If you would prefer to have personalized help in sorting through these changes and selecting the Medigap plan that is right for you, contact a licensed Medicoverage agent. We are here to help.