Comparing Exchange Plans: Bronze, Silver, Gold, Platinum

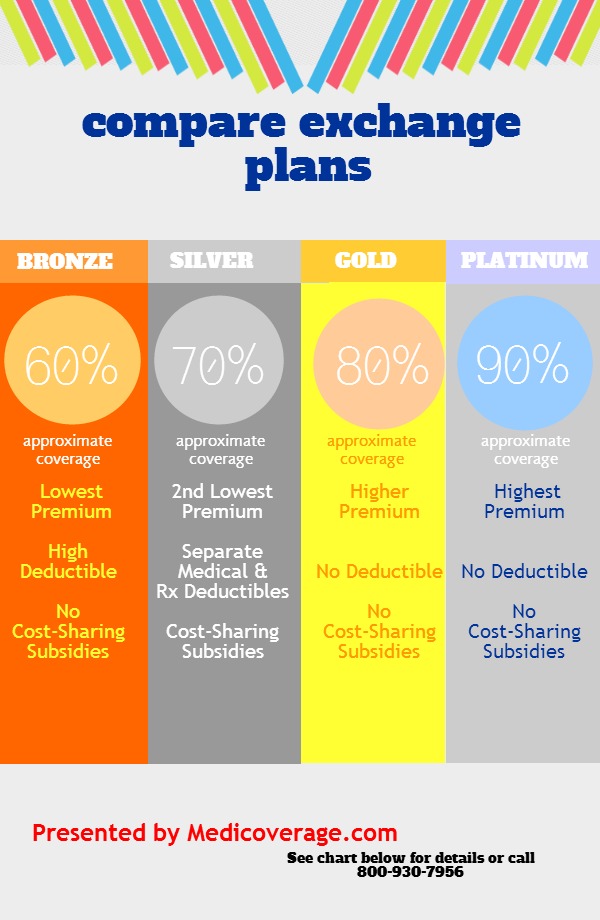

The Affordable Care Act, commonly known as ObamaCare, has four new health insurance plans which set the standard of care, named Bronze Plan, Silver Plan, Gold Plan, and Platinum Plan*. All plans must offer the same ObamaCare essential benefits, however individual providers and states may offer extended or additional benefits. This page is dedicated to comparing the four plans.

*There is also ObamaCare catastrophic coverage for those who qualify.

Plan Basics

The below information is for families and individuals. Click here for information about ObamaCare Small Business Owners. This information does not include the two types of federal subsidies: premiums and cost-sharing, click here if you want to learn Are You Qualified for Premium Subsidies? or if interested to learn, Are You Qualified for Cost-Sharing Subsidies?

| Benefits** | Bronze | Silver | Gold | Platinum |

| Deductible | $6,000 Med/ $500 Rx | $2,250 Med/$250 Rx | $0 | $0 |

| Preventive | $0 | $0 | $0 | $0 |

| Doctor’s Office Visits | $70 for first 3 | $45 | $35 | $20 |

| Specialist | $90 after deductible | $70 | $55 | $40 |

| Generic Rx | 100% per script up to $500 after deductible | $15 | $15 | $5 |

| Brand RX | 100% per script up to $500 after deductible | $50 after Rx deduct | $50 | $15 |

| Lab Testing | $40 | $35 | $35 | $20 |

| X-ray | 100% negotiated rate | $65 | $50 | $40 |

| Maternity | 100% of negotiated rate | 20% of negotiated rate, after deductible | $600 per day HMO***/20% PPO | $250 per day HMO***/10% |

| Out-patient Surgery | 100% of negotiated rate, after deductible | 20% of negotiated rate, after deductible | $600 HMO/20% PPO | $250 HMO/10% PPO |

| Hospital Stay | 100% negotiated rate, after deductible | 20% of negotiated rate, after deducible | $600 per day HMO***/20% PPO | $250 per day HMO***/10% |

| ER Visit | 100% of negotiated rate | $250 after deductible | $250 | $150 |

| Urgent Care | $120 after deductible | $90 | $60 | $40 |

| Out-of-Pocket Max | $6,500/$13,000 (ind/fam) | $6,250/$12,500 (ind/fam) | $6,200/$12,400 (ind/fam) | $4,000/$8,000 (ind/fam) |

| Details | Bronze Plan | Silver Plan | Gold Plan | Platinum Plan |

***Up to 5 days in the hospital

**Because California has standardized its health plans these are the costs associated with them. Each state will vary. Call 800-930-7956 or click here to get an exchange quote in your state.

Which is the right Healthcare Exchange plan for you?

To select the right health plan, you should ask yourself 5 key questions:

- 1) Do you qualify for federal cost-sharing subsidies and/or only federal premium subsidies?

- 2) What will your actual monthly premium cost?

- 3) What are the finalized coverage details of each plan?

- 4) What is the right amount of coverage for your lifestyle and medical history?

- 5) What is the plan’s network of doctors and hospitals?

ACA Application

There is now a website where you can get your paper application and access an agents help with subsidies and picking a plan. Here’s what you do:

- 1) Go to Healthapplication.com

- 2) Fill out the application

- 3) Print and then fax, scan and email, or mail your application to the contact information on the app*

- 4) An agent will contact you to inform you of your subsidy status and explain the new plans

*Make sure to send your application in as soon as possible to ensure the earliest possible start date.

Call the number above or contact a Medicoverage agent with any questions.

Comments and Questions

Click to leave a CommentComment from Paulette on March 19, 2016

My son currently has BCBS silver HMO plan through the Marketplace. Very satisfied with coverage and premium; however, he has recently received notice from his employer that based on hours worked he is being offered insurance through the company with company paying about $80 month and his share of the premium for a comparable silver plan would be $262 month. He currently pays $103 a month. He only makes about $8,50 an hour and works between 30-35 hrs weekly. He can’t afford that much of an increase. The Bronze plan would be more affordable but coverage does not appear adequate. Is there a way from him to continue his coverage through the marketplace even though he is being offered an expensive policy from the workplace?

MEDICOVERAGE AGENT RESPONSE

Paulette,

Good news! Your son may be able to maintain his marketplace insurance if his job-based insurance is more than 9.66% of his income (which with some rough calculations based on the information you gave, it looks like if he paid their premium it would be over 20% of his income). You will want to contact the company he works for and the marketplace he purchased insurance from to confirm what he qualifies for. When he’s ready to switch to another marketplace plan, please call one of our licensed independent insurance agents at 800-930-7956.

-Amy from http://www.medicoverage.com/

Comment from Joelm on March 04, 2016

As far as I know those metal level coverage (Platinum, Gold and so on) categories as Metallic.

I see in some government reporting Catastrophic coverage categories as Metallic as well.

Is an error? By definition catastrophic coverage is not Metallic.

Can you clarify, please?

Thanks.

MEDICOVERAGE AGENT RESPONSE

Joelm,

You are correct, Obamacare Catastrophic coverage is not a metal plan, and it does not meet the ACA requirements for coverage -but since there are specific rules for enrollment, many people enrolled in this plan are exempt from penalties.

-Michelle from http://www.medicoverage.com/

Comment from Karen on December 12, 2015

How does one find which hospitals in the area accept a silver plan HMO? I live in the 33186 zip code, and I am eligible for a $179 per month subsidy through the ACA. I am 24, very healthy, and a nonsmoker. I only want insurance in case of an accident.

Also, if the plan I choose has a $6,000+ deductible, would I be responsible for the total costs for medical care until that deductible is met? Would those costs be negotiated costs or the doctor or facility’s standard charges?

Having been unable to locate answers to these questions I have not yet chosen a plan.

MEDICOVERAGE AGENT RESPONSE

Karen,

Good questions. To see the network of doctors and hospitals, first, get a health insurance plan quote, from there you can view doctors and providers.

If you choose a plan with a deductible of $6000, you would have to meet the deductible before the plan pays (unless the plan specifies there is some services covered before you meet the deductible), and most plans have a negotiated rate that you pay before you pay your deductible. Hope this helps!

-Michelle from http://www.medicoverage.com/

Comment from Stella on November 30, 2015

I would like to find out if I can get obamacare as a supplement to cover infertility (IVF) treatments?

Thanks!

MEDICOVERAGE AGENT RESPONSE

Stella,

Thank you for your question. You usually can only have one insurance at at time. However, since we don’t know your specific situation, it would be easier to discuss on the phone. Please call 800-930-7956.

-Jacima from http://www.medicoverage.com/

Comment from linda on November 02, 2015

I have to take a expensive drug for cancer prevention called exemestane. Is that drug covered under these plans or do I have to reach my deductible before it kicks in? Also are there lifetime maximum benefits for these plans?

MEDICOVERAGE AGENT RESPONSE

Linda,

We’d be happy to help you find out if this drug is covered. We would need your zip code to look up plans to see which plans are available in your area, and if they cover your cancer prevention drug. As for the second part of your question, some plans have deductibles, while others don’t. If you prefer a plan with a low or $0 deductible, we can look those up. Finally, there are no lifetime max that the plan will spend, but they can put limitations on certain services.

-Chris from http://www.medicoverage.com/

Comment from Eileen on November 01, 2015

Can you suggest a plan that covers fertility and IVF in Illinois?

MEDICOVERAGE AGENT RESPONSE

Eileen,

We are finding conflicting accounts for Illinois’ IVF coverage on whether group (25 and more) only plans offer IVF treatment, or that individual plans can also cover it. Please contact us with your Illinois zip code, so that we can look up plans in your area that may offer IVF.

-Jacima from http://www.medicoverage.com/

Comment from CTC on September 25, 2015

Can you suggest the best plan and process to undergo Fertility treatment (IVF) in New York City?

MEDICOVERAGE AGENT RESPONSE

CTC,

Unfortunately, as of now, New York State has laws that specifically exclude IVF coverage. So there are no plans available that will cover the treatment in the NYC.

-Amy from http://www.medicoverage.com/

Comment from Suma on March 24, 2015

Can you suggest the best plan and process to undergo Fertility treatment (IVF) for the Texas state

MEDICOVERAGE AGENT RESPONSE

Suma,

Thank you for your question. As far as our understanding goes, at this point, in Texas only group plans offer IVF treatment (can be exempt for religious reasons) under specific circumstances. Please let us know if you need further help with this or if you learn of any individual plans offering it by calling 800-930-7956.

-Amy www.medicoverage.com

Comment from LJ Kramer on March 12, 2015

Does the Gold plan cover oxygen & hospital bed? Does it include any dental or eye care?

MEDICOVERAGE AGENT RESPONSE

LJ,

For specific coverage you would want to look at the explanation of benefits provided by your provider. Usually, dental and vision are stand-alone plans. Call us at 800-930-7956 for any further questions.

-Amy www.medicoverage.com

Comment from Hello Kitty on November 10, 2014

I have Platinum HMO, can I also have HSA to help to pay for the $250 per day hospital stay, $20 copy doctor visit, dental visit (I do not have dental insurance) etc…..?

MEDICOVERAGE AGENT RESPONSE

Thank you for your question. HSA plans are high deductible plans that can be offered on the exchange but would not be a Platinum plan. You should be able to switch to a HSA compatiable plan during ACA open enrollment (starts Nov 15th). Call 800-930-7956 and an agent can help you decide if an HSA or a traditional plan is right for you. At that time you can decide if you want a purchase stand-alone dental plan, as well.

-Chris from www.medicoverage.com

Comment from Patty on July 23, 2014

I live in Florida. My son lives in Virginia Beach, he’s 38 years old & has been diagnosed with several severe psychological problems which make it difficult/impossible to attain/maintain employment. He can no longer afford his medications & his home is soon being foreclosed on. How is he supposed to be able to afford ANY kind of insurance let alone the penalties for not having any insurance…? We help as much as we can with money for food & basics but are not in a financial position to do more for him. What does he do when the government starts charging him penalties?

MEDICOVERAGE AGENT RESPONSE

Patty,

Great questions. We understand that the ACA penalties can be frustrating. There are options of subsidies (where the government pays some if not most of his costs) if he qualifies for one of the new plans, if not he may be covered for 100% under Medicaid, and if he has a low enough income he will not be penalized for not having insurance. To help find the right plan or program for your son call 800-930-7956.

Chris from www.medicoverage.com

Comment from IM on February 05, 2014

If I have chrones and using Humira, will my prescription be only $50.00 on the platinum plan?

MEDICOVERAGE AGENT RESPONSE

IM,

Thanks for your question. The chart above is based off of California’s figures and may not be accurate for you. For your specific prescription cost in your state please call 800-930-7956.

Chris at Mediocoverage.com

Comment from Robert Coln on January 24, 2014

If subsidies are available for the Platinum plan, why would anyone who receives MAXIMUM subsidies and help with their deductibles and co-pays ever choose any plan but the Platinum plan?

MEDICOVERAGE AGENT RESPONSE

Robert,

Thank you for the question. There are two types of subsidies available: federal premium subsidy and cost-sharing subsidies. So, if you were to receive the maximum subsidies for both, Silver would be the better option. The reason is Silver is the only plan that reduces deductibles, copays, and coinsurance. For help learning which subsidies you qualify for call 800-930-7956.

-Michelle @medicoverage.com

Comment from J.Watson on January 16, 2014

I am not working right now and my husband works for himself. How are we suppose to know what our income will be in 2014? I understand that this is what is needed to apply for the subsidies and what will happen if we over or under estimate?

MEDICOVERAGE AGENT RESPONSE

J,

Thanks for your questions. You will have to estimate your income for 2014 but, according to the CMS, you are able to adjust it anytime. Hope that helps.

Michelle @medicoverage.com

Comment from carmen logan on December 20, 2013

bronze plan is what i want.

Comment from pete wetherell on December 03, 2013

u ask for last years income to base the rate. i lost my job in jan 2013. no income, no ins. the cheapest rates, the hope to pay any deductible, are beyond possibility. those rates don’t include eye and dental care. my medical condition precludes ambulation. i volunteer to teach. but not eligible for hiring if temporarily unable to walk halls, classrooms.

Comment from RS on November 30, 2013

How will I be able to find out if my current doctors will participate in any of these plans? Will referrals be required to see specialists?

MEDICOVERAGE AGENT RESPONSE

RS,

Thank you for your question. Referrals are required in certain plans like HMOs, however it is not required of all plans. The insurance providers are just starting to submit their doctor networks. To learn which doctors are participating in a particular plan call us 800-930-7956.

-Eric at Medicoverage.com

Comment from Mike on November 30, 2013

Hi, I had a kidney transplant when I was 16 years old (7 years ago). I am having trouble deciding which plan to choose. My family makes about $45,000 a year. They do not have insurance through their employers. I am still in college. My main medical cost are: I see a kidney specialist every 4 month and has lab work every month. What plan is best under my circumstances?

MEDICOVERAGE AGENT RESPONSE

Mike,

Thanks for your question. While bronze may be the least expensive plan when comparing premiums, you may save money by getting a plan with a smaller deductible. Due to the nature of your specific question we suggest you call 800-930-7956 to speak with an agent to figure out which is the exact best plan for you.

-Eric from Medicoverage.com

Comment from Richard Johnson on November 15, 2013

I am 60 and single and if I purchase the gold plan for 452.00/month($5,424 a year) and go to the doctor 4-5 times a year, total $150.00 and take prescription drugs totaling $235.00 a month ($2,820 a year) Then I can expect to spend $8,390.00 on healthcare right

MEDICOVERAGE AGENT RESPONSE

Richard,

Thank you for your question. The cost-share amounts for the Gold Plan vary by state and sometime even by provider. We are not able to answer your question without knowing which state you are in and which provider is offering the Gold Plan. However, from what you are saying, you may find that a Platinum plan may work better for you, due to the lower cost-sharing, even though it has a higher monthly premium. Call us at 800-930-7956 and we will be able to give your specific plan information for you.

-Michelle from Medicoverage.com

Comment from Chuck on November 15, 2013

Hey Anonymous…

There are subsidies for platinum plans. Why do you think subsidies aren’t available? The monthly subsidy would be the same regardless of which plan you get.

Comment from Anonymous on November 13, 2013

No subsidies for platinum plans? What kind of shit is that? Continue the fight for HR. 676. 100% coverage for a sliding medicare tax. Come on America, we can do better than this.

Comment from Katherine on November 06, 2013

My husband is a 63 year old retiree of our state government. So, we may continue with our current insurance for as long as we want, at the full cost of over $1800 a month for the current plan. (It compares to the “Platinum” plan of the ACA) Paying for this would take some 40 percent of our income. Would we be eligible for tax subsidies if we stay with this insurance? So far, the state I live in, which is part of the “federal exchange,” has no plans offering either of the predominant healthcare provider networks in our area. I love the idea of the ACA, but the actual logistics are, to put it mildly, incomprehensible, Thanks!

MEDICOVERAGE AGENT RESPONSE

Katherine,

You should qualify for the subsidies if your household income for a family of 4 is roughly $94,000 or under. Call us at 800-930-7956 and give us the state and actual income and we will be able to tell you if you qualify for subsidies, as well how much your specific subsidy would be.

-Michelle from Medicoverage.com

Comment from gringo on October 31, 2013

The chart has nany items followed by a single asterisk. But there is no explanation for the asterisk down below the chart. Pls explain!

MEDICOVERAGE AGENT RESPONSE

Gringo,

Thanks for the feedback! The single asterisk denoted that those prices are only available after the deductible is met. We removed the single asterisk from the chart and included the additional information in the actual field to to make it less confusing.

-Eric from www.medicoverage.com

Comment from Carol on October 20, 2013

My son called into the healthcare.gov phone number after not being to get through for two weeks online. He was assigned an ID#, but he was never asked questions regarding his income. He did provide his SS# however.

So how does he proceed now? Is there a way he can go online now at healthcare.gov to get to the various types of coverage he can purchase and see if he is eligible for any assistance? He lives in Texas. Thank you

MEDICOVERAGE AGENT RESPONSE

Carol,

Thank you for your question. Many of clients have experienced the same delays as your son. Tell him he is able to work with an agent. That way he doesn’t have to wait for a long time. But until doctor and hospital networks are available, however, we are suggesting that people wait to enroll. Also, remind him there isn’t a rush, as he is able to enroll until Dec 15th for a January 1st start date. When he’s ready have him give us a call at 800-930-7956.

-Chris from Medicoverage.com

Comment from Jeremy on October 13, 2013

So how do I enroll me and my family right now!! Please help me avoid the rush

MEDICOVERAGE AGENT RESPONSE

Jeremy,

We completely understand your concern. There are lots of traditional plans to enroll in now that will offer you coverage before January 1, 2014. You can get a quote and enroll here quote and enroll here

If you are looking one of the new ObamaCare plans, those begin in 2014 and the rush has already started. Most of our clients have really struggled to sign up in the first 10 days of the October. We don’t recommend you sign up for these plans until they have solved the technical issues and offered working links to plan details and doctor networks. You have until Dec 15 to sign up for coverage to begin on Jan 1. We are authorized to assist people to sign up so please feel free to call us at 800-930-7956.

-Kelly from Medicoverage.com

Comment from chuck on October 04, 2013

we make about 25k per year and don’t see the dr. only about once every 3 months for checkup and monthly maintenance meds costing about $50 in copays. how does this subsidy dollar figure come into play, as I’ve read on the site that you can get up to a certain amount of your subsidy money back from your plan say the Bronze, which is about $8,500 or you can get it back on your fed. taxes when you file, along with our children tax credits. what affects how much of the subsidy money you get and how would you be able to get the most of your max subsidy money back. Also what plan would go the best as we are also in Chapter 11 bankruptcy, as I’m disabled with Social Sec. disability each month.

MEDICOVERAGE AGENT RESPONSE

Chuck,

Thank you so much for your question. Because this is a very specific question I suggest you give us a call at 800-930-7956.

But to give you a general idea, premium subsidies (help with your monthly policy cost) are available on all plans, but if you qualify for cost-sharing subsidies (help with deductibles, copays, and coinsurance -basically financial when you seek medical care) you could only enroll in the Silver plan. And the good news is subsidies are available immediately, you do not need to wait till tax time.

Again, please feel free to call us, so that we can help you out in your unique case.

Chris from Medicoveage.com

Comment from Robin Snowden on October 03, 2013

After all the hunting on the internet…..I still can not find a screen that lets you compare the bronze,silver,gold or platinum plans side by side. please help

MEDICOVERAGE AGENT RESPONSE

Robin,

While the chart above is a good start at letting you see the differences between the 4 plans, it will not help you decide which plan is exactly right for you in your state. Each state, and in most cases each insurance provider, can offer different deductibles and copays for the bronze, silver, gold and platinum plans making comparison very difficult.

States are just now releasing details of each plan and we are posting up information as soon as it is available. If you have specific questions about benefits in your state, please give us a call at 800-930-7956.

-Kelly from Medicoverage.com

Comment from Phil on October 01, 2013

Will the ACA offer high deductible plans with Health Savings Accounts? I currently have such a plan with deductible of roughly $4000. With three surgeries in the past 1.5 years with costs of over $500,000, I have been happy to pay my $4000 deductible each year after which insurance pays everything. I am hoping I can find something similar since the insurance company notified me that they will not be offering the same plan after my coverage period ends 4/14.

MEDICOVERAGE AGENT RESPONSE

Phil,

Thank you so much for your question. Insurance companies still have the choice to offer HSAs under health care reform. There are two ways to get an HSA plan for 2014:

1) Purchase an off-Exchange plan with a high-deductible or

2) Select a new ACA high-deductible HSA exchange plans.

Click the links to learn more or call us at 800-930-7956 to learn about which plan will work for you in your state.

-Kelly at Medicoverage.com

Comment from Jim on September 29, 2013

“That is coming from someone who actually knows insurance. According to the chart above if you had a heart attack you would max out your plan and it would cost you $4000.”

Cost sharing is 10%, with zero deductible. So, if your medical bill was $40,000, you would pay $4,000 and the insurance company would pay $36,000. If it were $100,000, you would pay $4,000 and the insurance company would pay $96,000. Here on earth, that is excellent coverage for an individual policy.

Comment from sandy on September 22, 2013

Ya Carnes, What are you talking about max out your plan?With a catastrophic illness, your max would be $4000.That is just a drop in the bucket for what the insurance would be paying. I’m sorry but what an idiot. Have you done the calculations. I think for what we would be saving in premiums, the plans look good to me. I was paying $500he . month no preventative, I think my deductible was 4,500. No Dr. copays until after deductible was met.I wonder if the insurance companies will start to sell supplements for these like the medicare has supplements? Sandy

Comment from Mark Wilson on September 20, 2013

Carnes,

$1000 out of pocket maximum? What country do you live in? There are no affordable plans for sell right now pre-obama care that have a $1000 total out of pocket maximum. You say you know insurance but I think you are confused with deductibles. Most of these companies add co-insurance. I dare you to show me a plan that people can afford that has a $1000 out of pocket maximum.

Comment from marta on September 20, 2013

We’re going to be paying HIGH PREMIUMS FOR SHITTY PLANS. OPT OUT. If my coverage decreases from what it is currently and the premiums are higher I’m going to drop coverage altogether. What a ripoff.

Comment from carnes on September 18, 2013

These plans are garbage! That is coming from someone who actually knows insurance. According to the chart above if you had a heart attack you would max out your plan and it would cost you $4000. What is the premium associated with the best plan offered? I’d bet it’s not cheap.

Who came up with these max out of pocket rates? Surely not someone in the insurance business. There should be a $1000 or $2000 total out of pocket program!!!!

MEDICOVERAGE AGENT RESPONSE

Carnes,

Thank you for your comment. If you are unhappy with the out of pocket maximums listed above, you can still purchase a traditional insurance plan at http://www.medicoverage.com/quote.php These should still be for sell until Dec. 31, 2013.

Rates for the new ACA plans (which start Jan 1. 2014) depend on where you live, your age, provider you choose, type of plan (HMO or PPO), level of coverage (Bronze, Silver etc) and if you qualify for a subsidy. Please call us at 800-930-7956 for your specific monthly premium and to see if you qualify for subsidies to help you out.

-Kelly from http://www.medicoverage.com

Comment from Chloe Charles on May 17, 2013

This is really helpful. I am wondering if I’m reading it right that with the Silver Plan you don’t have to meet your deductible to see a doctor whenever you want?

MEDICOVERAGE AGENT RESPONSE

Chloe,

Based on the information we have so far the Silver Plan in California will just require a copay of $45 dollars to see a doctor ($65 to a specialist). As you inferred you will not have to meet your deductible first on this plan. We don’t details on how the Silver plan will work in other states and this is all subject to change so please refer back to this site or call us when it gets close to Oct. 1, 2013.

-Chris from Medicoverage.com