Medicare Planning: 6 Things All Medicare-Eligibles Should Do Today

Many Seniors 65 and over are very independent and are living their lives with little to no assistance. As November is National Medicare Family Caregiver’s Month, we decided to write an article about what you and family can do now to ensure you maintain your best healthcare as you get older.

1) Talk to Family Today

Seniors need to sit down and talk with their family about their future healthcare needs in advance. Right now, you may not foresee any complications with your health in the near future but when accidents happen, you may not be in a position to communicate your wishes. Craig Fukishama, a consultant at the Fox Group, says, “Don’t wait to plan.” He goes on to say, “It is too late when something serious happens.”

The following is a quick list of questions that you should discuss with your family member is advance. Some of the questions should be part of a formal Living Will that you can develop with legal assistance.

- Who is the emergency contact?

- Which doctors are your currently working with?

- What drugs are you currently taking?

- Do you qualify for Medicaid?

- What additional insurance you have purchased? (See number 2 below)

- Do you want to be resuscitated, etc?

2) Consider Senior Insurance

Medicare will not cover all your medical costs should you be sick or injured. As the New York Times states, “The average married couple retiring this year at age 65 need $220,000 to cover health costs throughout retirement.” You should consider getting additional coverage to keep the high cost of medical bills in check. Here is a list of insurance you may want:

- Medicare Advantage or Medigap (you can’t have both!)

- Long Term Care

- Optional Medicare Part D prescription drug coverage

- Vision

- Find out does Medigap covers dental

3) Understand Medicare’s Rules

Many seniors don’t understand what is exactly covered under Medicare and don’t know the protocol to follow to to get reimbursed for expenses. Adria Gross, of Med Wise Billing, says that seniors and their families don’t understand that you need a 72 hour qualifying hospital stay to have Medicare cover their share of Skilled Nursing care.

“Someone was out in California at the hospital for three weeks and they were not covered by Part A [Medicare] for the Medicare bill,” Gross states because this patient was being held under “observation,” not considered admitted. Gross goes on to say, “You’ve got to really ask, because they think because they are at the hospital they are considered an in-patient, but many times they will still be considered as an out-patient.”

Gross stresses that patients should ask after a few hours at the hospital what there in or out-patient status is. Asking the right questions can save thousands of dollars, but if you are not familiar with how medicare works you will not be able to ask the right questions.

4) Be Smart About Drugs

Seniors should be vigilant about how they take their drugs and how they will be paid for. Jen Wolfe, a pharmacist in the DC area started her own consulting firm ( Mymedicationexpert.com) after a client of hers had a heart attack in her pharmacy because he was not taking his drugs as prescribed. She suggests the following steps for seniors to be smart about drugs:

- Talk to their doctors and pharmacists about all the drugs they are taking to make sure there isn’t an adverse reaction from a combination of drugs

- Have Medicare Part B, because it covers cancer drugs, injectibles, nebulizers, and anti-nausea drugs

- Get a Medicare Part D prescription drug plan, even if they are not taking a lot of medications currently

- Take all drugs as they are prescribed

- Put extra money aside each month for possible drug cost increases

- Go to the Medicare website and look up all the their current drugs to help decide which drug plan to enroll in

5) Use Medicare Preventive Services

Senior healthcare is not just about worrying about the financial end of things, it’s also about making sure that you use all of Medicare’s or your Medicare Insurance’s preventive services. With many of the Medicare Supplemental plans (Medigap plans) and MA plans including gym memberships, seniors should utilize this benefit to improve balance and prevent disease. Also the ACA has included $0 charge for Medicare preventive care beneficiaries that include tobacco cessation counseling, vaccinations, and mammograms.

6) Avoid Falls (not the Niagara type)

Fukishama says that one of the main reasons seniors are at Long Term Care facilities is due to a fall, and many times it is because their vision had diminished. Get an annual vision checkup to make sure you peepers are in order.

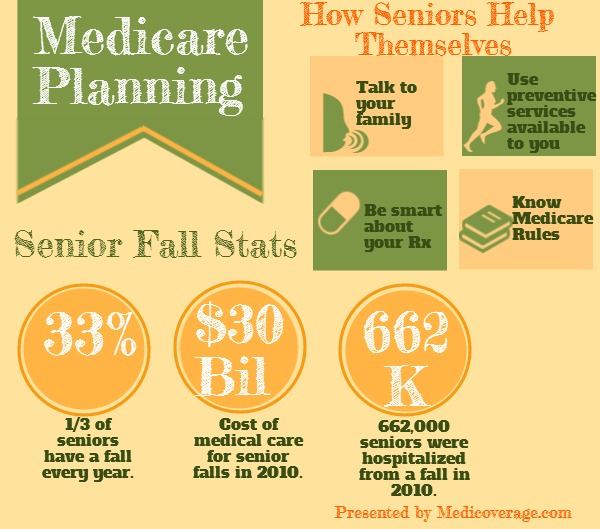

As well as, according to Centers for Disease Control and Prevention, 1 in 3 seniors has a fall every year. Falls are leading cause of both non-fatal and fatal injuries among seniors. “In 2010, 2.3 million nonfatal fall injuries among older adults were treated in emergency departments and more than 662,000 of these patients were hospitalized,” according to the CDC. And the CDC explains how costly falls are for American seniors, “In 2010, the direct medical costs of falls [adjusted for inflation] was $30 billion.”

Conclusion:

Family members often become the default caregivers when seniors become ill or injured. If you plan ahead and make smart decisions you can give them the tools to really assist you and maybe even postpone needing their help with some preventive planning.

Comments and Questions

Click to leave a Comment